Unveiling the Costs of Life Insurance with Pacific Life

Unveiling the Costs of Life Insurance with Pacific Life

When it comes to protecting your loved ones financially, life insurance is one of the most crucial investments you can make. Pacific Life has been a trusted name in the insurance industry for over 150 years, offering comprehensive life insurance policies to meet various needs. But what exactly are the costs associated with life insurance from Pacific Life? In this article, we’ll uncover everything you need to know about the costs involved.

Understanding the Basics of Life Insurance

Before delving into the costs, let’s start by understanding the basics of life insurance. Life insurance provides a lump-sum payment, known as the death benefit, to your beneficiaries upon your passing. This financial protection can help cover expenses like funeral costs, outstanding debts, mortgage payments, and income replacement.

Factors Influencing the Cost of Life Insurance

The cost of life insurance from Pacific Life is determined by several factors. Some of the key factors that influence the premium costs include:

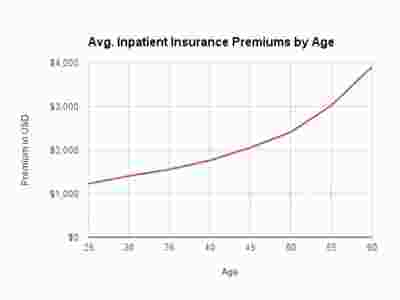

- Age: Typically, the younger you are when you purchase life insurance, the lower your premiums will be.

- Health: Your overall health and any pre-existing medical conditions can impact the cost of your life insurance policy.

- Gender: Generally, females tend to have lower life insurance premiums compared to males.

- Policy Type: The type of life insurance policy you opt for, such as term life or whole life, will affect the cost.

- Policy Duration: The length of your policy term will also impact the overall cost of your life insurance.

Frequently Asked Questions about the Costs of Life Insurance with Pacific Life:

1. How much does life insurance from Pacific Life typically cost?

The cost of life insurance varies depending on individual circumstances. However, Pacific Life offers a range of policies to suit different budgets. The best way to determine the cost is to request a personalized quote based on your age, health, and coverage needs.

2. Can I adjust my life insurance coverage to manage costs?

Absolutely! Pacific Life provides flexibility when it comes to coverage. You can customize the death benefit amount and policy term to find a policy that aligns with your financial goals. By adjusting these factors, you can manage the costs of your life insurance.

3. Are there any additional fees or charges involved?

While Pacific Life’s life insurance policies come with no hidden fees, it’s essential to understand the specifics of your policy. Some policies may have additional fees or charges, such as surrender charges for early policy termination or administrative fees. It’s crucial to review the policy terms and conditions to understand any potential charges.

4. Can I get discounts on my life insurance premiums?

Yes, Pacific Life offers various discounts to help you save on your life insurance premiums. These discounts may be based on factors like your health, lifestyle choices, and premium payment options. It’s recommended to speak with a Pacific Life representative to explore the possible discounts available to you.

In Summary

Investing in life insurance from Pacific Life provides peace of mind for you and financial security for your loved ones. While the cost of life insurance can vary depending on factors like age, health, and policy type, Pacific Life offers a range of affordable options. Remember to assess your individual needs and consult with a Pacific Life representative to find the best life insurance policy for you.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial or investment advice.

Now you have an SEO-friendly blog post about the costs of life insurance with Pacific Life, along with relevant headings and FAQs to provide valuable information to your readers.